Double Materiality in Practice: Addressing the Challenges for Sustainable Reporting

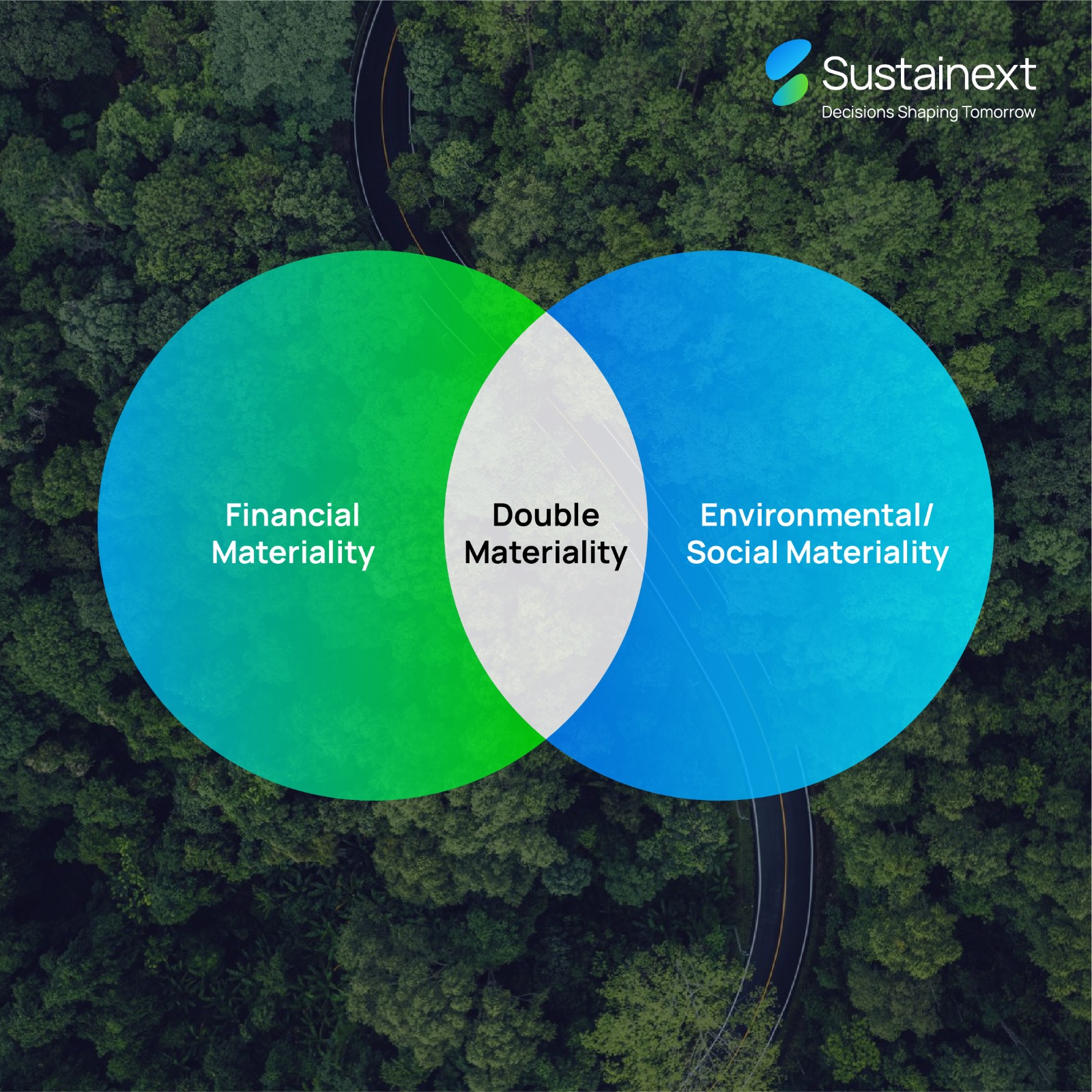

Double materiality is a concept that recognizes two dimensions of materiality: financial materiality and environmental/social materiality. Financial materiality focuses on how environmental, social, and governance (ESG) issues impact a company’s financial performance. Environmental/social materiality, on the other hand, considers how a company’s activities impact the environment and society. The concept has emerged as a crucial framework in sustainable reporting, pushing companies to consider both the financial impacts of sustainability issues on their business and their impacts on the environment and society.

This approach, prominently featured in the European Union's Corporate Sustainability Reporting Directive (CSRD), represents a significant shift in how organizations assess and report on sustainability matters.

EFRAG, responsible for developing the European Sustainability Reporting Standards (ESRS) under the CSRD, explicitly incorporates double materiality into its guidelines.

The GRI standards emphasize the need for organizations to report on material topics that reflect their significant economic, environmental, and social impacts, as well as topics that substantively influence the assessments and decisions of stakeholders, thereby embedding double materiality.

The IFRS Foundation's International Sustainability Standards Board (ISSB) is developing standards that are expected to include elements of double materiality, although the primary focus remains on financial materiality. This could evolve to incorporate broader impacts over time.

The SFDR requires financial market participants and advisors to consider and disclose how sustainability risks and adverse sustainability impacts affect their financial returns, aligning closely with double materiality principles.

However, implementing a double materiality assessment presents several challenges,

Accurate and comprehensive data is critical for double materiality assessments. However, companies often struggle with the lack of reliable data on ESG factors. A manufacturing company, for example, may find it challenging to obtain precise data on the carbon emissions of its supply chain, especially if suppliers are located in regions with less stringent reporting requirements.

No universal standard for measuring and reporting ESG impacts makes it difficult to compare and assess materiality consistently. For instance, financial institutions, for example, trying to assess the materiality of climate risks across their investment portfolio may encounter inconsistencies in how different companies report their greenhouse gas emissions or energy use.

Integrating double materiality assessments into existing financial and non-financial reporting frameworks can be complex. A multinational corporation might struggle to align its double materiality assessment with varying reporting standards and regulations across different countries where it operates.

Social impacts are often qualitative and harder to quantify compared to environmental impacts. A retail company, for example, might find it difficult to measure the social impact of its labor practices on worker well-being in different regions, making it challenging to assess their materiality.

Engaging a wide range of stakeholders to understand their perspectives on material issues can be resource-intensive and complex. An energy company may need to engage with local communities, environmental groups, regulators, and investors to get a comprehensive view of what is materially significant, which can be time-consuming and costly.

Companies often struggle to balance short-term financial impacts with long-term environmental and social impacts. A tech/IT company may face pressure to show immediate financial returns, which might conflict with long-term investments needed to reduce its carbon footprint or improve labor conditions in its supply chain.

The assessment of what is material from an environmental or social perspective can be subjective and vary across different stakeholders. A pharmaceutical company may consider drug pricing strategies as financially material, but patient advocacy groups may see access to affordable medication as the key social material issue.

Strategies to overcome challenges

1. Improving data Collection and reporting

• Implementing advanced data analytics and technology solutions to enhance data accuracy and comprehensiveness.

• Implement robust data management systems that integrate financial and non-financial data.

• Collaborating with industry peers to develop standardized ESG reporting frameworks.

2. Defining materiality thresholds

• Develop clear, industry-specific guidelines for materiality thresholds.

• Engage with stakeholders, including investors, customers, and local communities, to understand their perspectives on materiality.

• Regularly review and update these thresholds to reflect changing contexts.

3. Building internal capacity

• Training employees on ESG issues and double materiality assessment techniques.

• Establishing dedicated teams or roles responsible for ESG data collection and reporting.

4. Leveraging external expertise

• Partnering with external consultants or organizations specializing in ESG assessments.

• Participating in industry initiatives and alliances focused on improving ESG reporting standards.

Double materiality assessments are critical for companies aiming to integrate ESG considerations into their business strategies. While there are significant challenges, such as data availability, standardization, and stakeholder engagement, companies can adopt various strategies to overcome these hurdles. By improving data collection, engaging stakeholders, building internal capacity, and leveraging external expertise, companies can effectively navigate the complexities of double materiality assessments and enhance their ESG performance.

Sustainext helps companies in their Double materiality assessments helping them in reliable and comprehensive data collection, defining what constitutes as ‘material’ for both financial and impact perspectives, balancing short-term and long-term perspectives, understanding stakeholder perspectives, measurement and quantification of impacts, navigating through the complex reporting and assuring alignment with different reporting frameworks.